Table of Content

Home equity loans are popular among borrowers who want to use the funds to cover large expenses, such as home improvement projects or high-interest debt consolidation. Connexus has the fastest closing timelines among the lenders we surveyed, with about 25 days to close. It also has a lower required credit score and a higher CLTV than some lenders. Additionally, you may have to pay for title insurance, property insurance, flood insurance or certain taxes depending on the lender, the home’s location, your state laws or other factors.

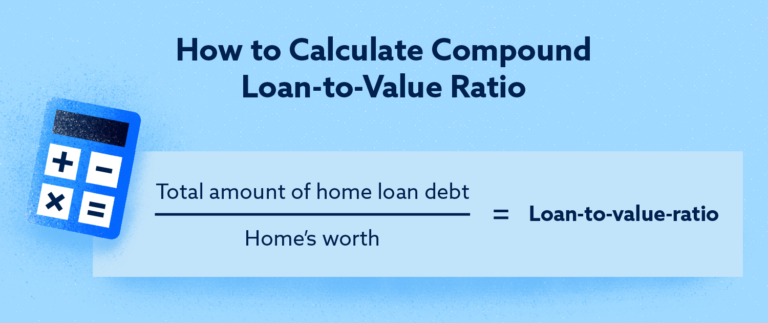

In addition, most lenders have a minimum threshold of $10,000 to open a home equity loan. The amount you can borrow depends on the equity you have in your home. Most lenders prefer borrowers to have at least 20% equity before they'll issue a loan. Most also limit their loans to no more than 80% of your equity.

Credit Unions

KeyBank’s terms are also flexible — lasting up to 30 years — making this bank a solid choice. After selecting your top options, connect with lenders online or by phone. Next, choose a lender, finalize your details and lock your rate in.

Customer support by phone is available on weekdays from 8 a.m. Customer support by phone is available Monday through Saturday from 7 a.m. Navy Federal home equity loans are available in all states.

Getting a home equity loan with bad credit

Equity is the difference between the current market value of your home and the amount you owe on it. You can use your home's equity to finance virtually anything, and these loans can offer tax advantages . Since a home equity loan is secured by the equity in your home, interest rates may be lower than other loan types. We offer many options that can put your home's equity to work for you. Have you ever considered borrowing against your home to cover another expense?

You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. You'll also want to make sure you're comparing loans with the same terms or lengths. Ryan Eichler holds a B.S.B.A with a concentration in Finance from Boston University. He has held positions in, and has deep experience with, expense auditing, personal finance, real estate, as well as fact checking & editing. As is usually the case with banks, experts tended to score BB&T/Truist more highly than consumers did. That may be because disgruntled customers tend to be more vocal on sites such as Trustpilot than happy ones.

Best Mid-Tier Home Equity Loan Product

The bank also allows you to get a “loan estimate” in real time, which would include the estimated interest rate, monthly payment and total closing costs. Other details—such as the minimum credit score required and average time to close a loan—are not readily available, and the bank did not respond to requests for information. Home equity loans come with low interest rates, no annual fee, flexible repayment terms and no closing costs. Borrowers may also qualify for a rate discount by setting up autopay from a Regions Bank checking account. Third Federal offers a wide array of banking and financial products, including home equity loans and lines of credit, mortgages and deposit accounts.

Many HELOC lenders allow borrowers to lock their rate for a certain balance, essentially turning a variable-rate HELOC into a fixed-rate home equity loan. Consumers worried about the uncertainty of rate changes can consider that if they want to guarantee a certain payment. HELOCs tend to have variable interest rates that track the Fed’s federal funds rate, so homeowners can see their payments rise when the Fed hikes rates even if they don’t borrow more money.

When you're looking for low interest rates on a loan, there's no clear-cut answer to which is better. In broad comparisons, similar interest rates can be found at small or regional banks as at large national banks. Home equity loans use your home as security, so their rates are often lower than other forms of borrowing. If you're a homeowner, you may be sitting on a golden egg—your home's equity. Rachel Murphy has 10 years of experience in personal finance. As a freelancer, she specializes in topics that pertain to the self-employed—leveraging good credit, tax benefits, health insurance, and investment strategies.

When you don’t have a lot of equity in your home, it can be difficult to find a lender willing to extend you credit. Fortunately, KeyBank lets you borrow up to 90 percent of your home’s value in a first and second mortgage if you qualify. You can borrow up to 90 percent of your home’s value with rates as low as 2.32 percent APR in some states.

Most home equity lenders allow you to borrow a certain percentage of your home equity, typically up to 85 percent. Established in 1868 and with 130 branches spread across Texas, Frost is a full-service bank that offers checking and saving accounts, personal loans, insurance, investment products and more. Frost’s customer service is also consistently highly rated. Borrowers have plenty of options when it comes to loan terms and amounts on BMO’s home equity loans. Plus, there are no application fees and you get a 0.5 percent discount when you set up autopay with a BMO Harris checking account. With a home equity loan, you typically receive a one-time lump sum of money at a fixed interest rate that you then repay over time.

The best home equity loan lenders offer a variety of repayment terms, low interest rates and few fees. Each lender will evaluate your eligibility differently, so shopping around can help you find the best offer. Your rate will depend on your credit score, income, home equity and more, with the lowest rates going to the most creditworthy borrowers. Over time, you build up equity in your home as you make payments on your mortgage or your home’s value rises. If you have built a substantial amount of equity in your home, you can take out a home equity loan.

Editorial content from NextAdvisor is separate from TIME editorial content and is created by a different team of writers and editors. Experts worry a recession, which is a possible outcome of the Fed’s rate hikes, will cause more people to borrow against their house to pay the bills. That’s risky, as having a loan or line of credit adds another bill on top, and failure to repay could jeopardize your home.

This table does not include all companies or all available products. Before joining Bankrate in 2020, he wrote about real estate and the economy for the Palm Beach Post and the South Florida Business Journal. Fixed home equity loans can be used for remodeling, educational expenses, debt consolidation, the purchase of a vehicle, and more. Insurance products are offered through Think Insurance (MN license # IA-538), not Think Mutual Bank.

There's no hard and fast rule about what kind of institution has the best rates; it varies from one lender to another. You’ve worked hard to build equity in your home, and there are many reasons you may decide to tap into that equity with a Home Equity Loan. Whether it’s funding home improvements, paying for school tuition or consolidating high-interest debt, a Home Equity Loan from Enterprise Bank & Trust provides the funds you need.

No comments:

Post a Comment