Table of Content

The bank also allows you to get a “loan estimate” in real time, which would include the estimated interest rate, monthly payment and total closing costs. Other details—such as the minimum credit score required and average time to close a loan—are not readily available, and the bank did not respond to requests for information. Home equity loans come with low interest rates, no annual fee, flexible repayment terms and no closing costs. Borrowers may also qualify for a rate discount by setting up autopay from a Regions Bank checking account. Third Federal offers a wide array of banking and financial products, including home equity loans and lines of credit, mortgages and deposit accounts.

A broker can shop for you and bring you competitive rates from several lenders. The Federal Trade Commission suggests checking the National Multistate Licensing System website to make sure that you're dealing with a legitimate one. Since credit unions are not-for-profits that are in business to serve their members, their interest rates are often more attractive. That can mean higher interest rates paid on deposit accounts and lower ones charged on loans.

Summary: Best Home Equity Loan Rates

You can get product, rate and fee info after you choose your location. Old National home equity loans are available in seven states currently. The exact amount you can borrow varies depending on the lender, but you can generally borrow up to 80 or 85 percent of your home’s appraised value. Risk of losing your home if you are unable to make the payment or ending up underwater on your mortgage if the home value drops. The bank scores an impressive A- on the Better Business Bureau and is known for providing its customers with helpful tools, like a mobile app and home equity calculators.

© 2022 NextAdvisor, LLC A Red Ventures Company All Rights Reserved. Use of this site constitutes acceptance of our Terms of Use, Privacy Policy and California Do Not Sell My Personal Information. NextAdvisor may receive compensation for some links to products and services on this website. “Many of these home equity products, unlike credit cards or anything else which is variable, allow you to lock in the price so that you have payment certainty,” Gupta says. The average interest rates for home equity loans and lines of credit were essentially flat this week.

Deposit ProductsProductos de Depósito

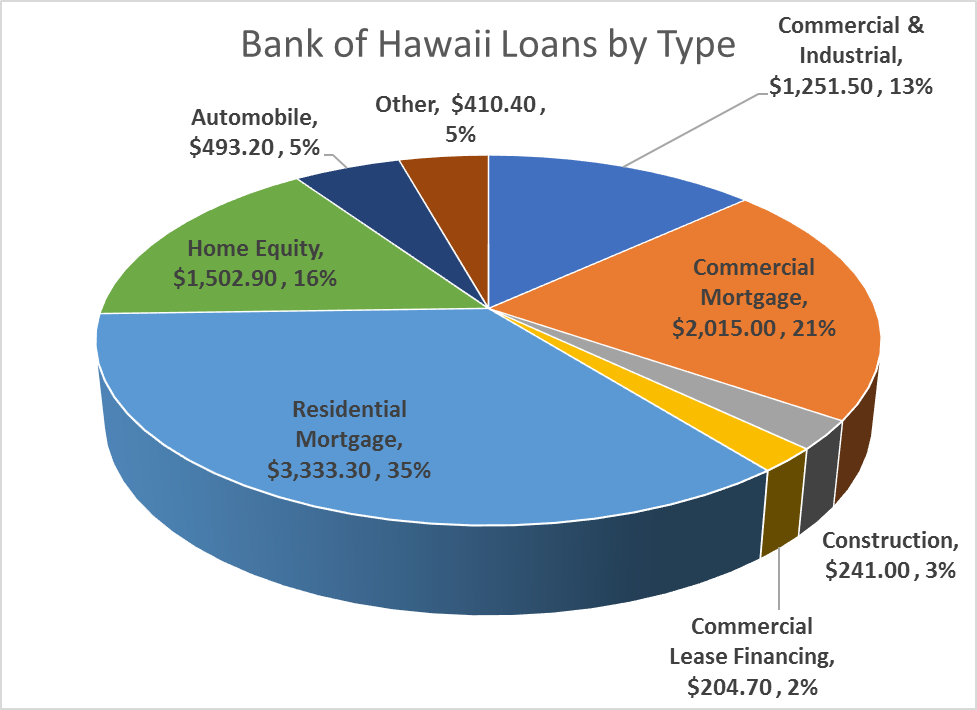

The bank is known for its dedication to helping customers achieve their financial goals through offering low rates and little fees. Home equity loans are available at many banks, credit unions and online lenders. You can use these funds for a range of purposes, including debt consolidation, home improvement projects or higher education costs.

You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. You'll also want to make sure you're comparing loans with the same terms or lengths. Ryan Eichler holds a B.S.B.A with a concentration in Finance from Boston University. He has held positions in, and has deep experience with, expense auditing, personal finance, real estate, as well as fact checking & editing. As is usually the case with banks, experts tended to score BB&T/Truist more highly than consumers did. That may be because disgruntled customers tend to be more vocal on sites such as Trustpilot than happy ones.

Credit Unions

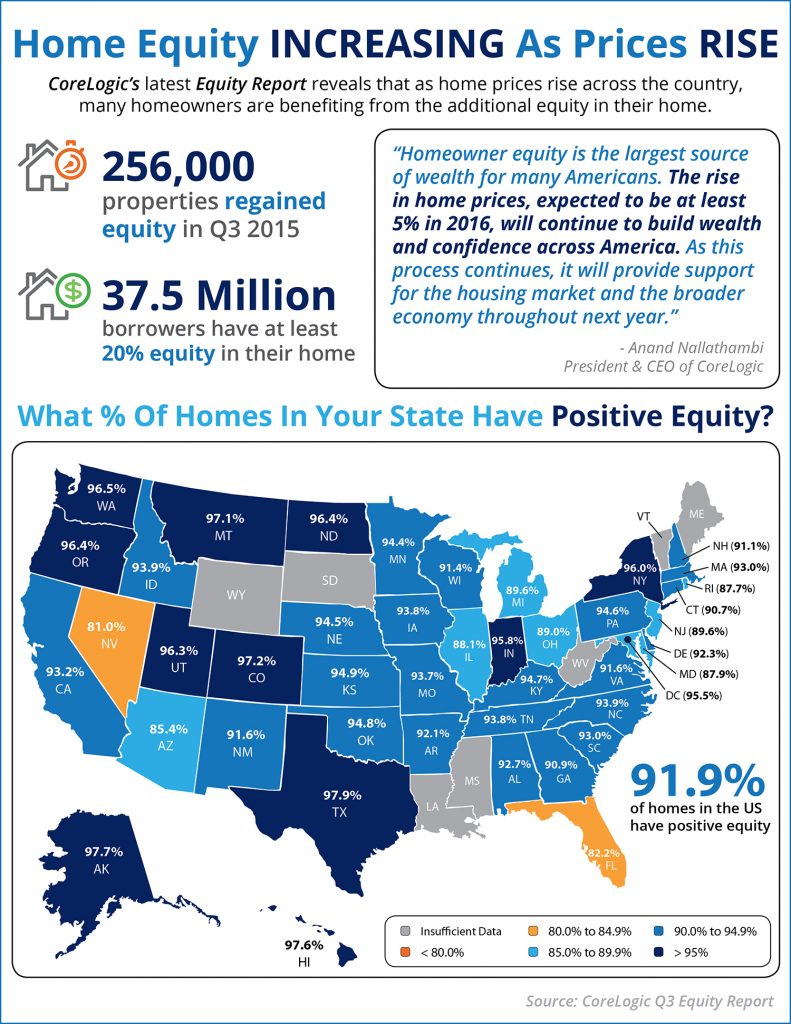

The loan amount depends on several factors like your income, credit history and the market value of your home. Typically, you can borrow 80% of the equity in your home. Home equity loans and HELOCs are secured loans, meaning if you don’t pay them back, the bank could foreclose on your home. That means they often come with more favorable interest rates and terms, but that’s because you’re carrying extra risk.

Many Americans are also prioritizing finding a higher-paying job , saving for a non-essential purchase such as a vacation or big-ticket item , buying a new home or investing more money . More often than not, Americans have a specific set of financial goals for 2023, even as high inflation makes it tougher to budget and save. The majority of Americans who say their finances won’t improve next year say continued high inflation will be to blame.

Best Mid-Tier Home Equity Loan Product

We chose this bank as the best for low rates because of its national reach (Discover is available in all 50 states and Washington, D.C.) and low rates. Established in 1935, Connexus offers auto loans, personal loans, student loans, credit cards, banking products and more. Connexus’ home equity loan rates are on par with those of other financial institutions on this list, starting as low as 3.49 percent APR.

As noted, BB&T was not offering home equity loans when this review was written. Potential borrowers should therefore visit the bank’s website to check whether home equity loans through Truist have since been made available. Of course, anyone who has decided that a home equity loan is what they need can also apply to other banks and lenders for one. BMO offers home equity loans from five to 20 years, with loan amounts starting at $5,000. While there are no closing costs, if you pay your loan in full within 36 months, you may incur a fee for the bank to cover the costs of closing the loan initially.

You may also need to pay fees for a loan application, credit check and home appraisal. A home equity loan is a lump sum that you borrow against the equity you’ve built in your home. Most lenders will let you borrow up to 80 percent to 85 percent of your home’s equity; that is, the value of your home minus the amount you still owe on the mortgage.

We have home loan options that are perfect for every life stage! 100% of our personal loans are approved, financed and serviced locally. That means if you have questions or need attention, you’ll never be redirected to a random number. Take a break from credit cards and try something different – a classic line of credit. You’ll enjoy more flexibility and low interest rates for that home renovation or much-needed vacation.

While the federal funds rate is a short-term rate that affects what banks charge each other to borrow money, it does have some direct effects on consumers. For home equity loans, increases in what it costs for a bank to borrow will lead to higher rates being passed along to homeowners. The effect on HELOCs is more direct – many have variable rates tied to the prime rate, which directly tracks the federal funds rate.

The Federal Reserve on Wednesday announced its latest rate hike, which will have an impact on interest rates for home equity lines of credit. ITHINK Financial does not provide, and is not responsible for, the product, service, overall website content, security, or privacy policies on any external third-party sites. These sites may not be conformant with current ADA requirements. If you continue, an external website that is owned and operated by a third-party will be opened in a new browser window. Transfer your payment from your account at another financial institution using eTransfers or contact us to set up a recurrent Direct Payment.

The Federal Reserve again raised its benchmark interest rate, but only by half a percentage point. A change in the index of one percentage point will result in one percentage point change in the same direction in the loan’s APR. Next, calculate how much you may borrow by multiplying your home's value by the lender's maximum LTV ratio and subtracting your mortgage balance.

You are leaving Provident Bank's website and going to a third party website. The site you are about to enter may have a privacy policy different from Provident Bank. Never disclose any financial information on a third party site. We are not responsible for the privacy and security policies or practices of sites outside of Provident's website. Provident Bank and its affiliates are not responsible for the products, services and content on any third party website. With your days so busy and life so full, you need a bank that can keep up with the lightning pace of change.

No comments:

Post a Comment